Sg&a Expense Selling, Common & Administrative Information, Examples

Corporations should transfer rapidly to install the new furnishings while preserving clear data and paying for it through the correct channels. Companies seeking to minimize prices typically transfer to remote work because it is a cheaper possibility. This follow has turn out to be commonplace for the explanation that mainstreaming of remote work during the COVID-19 pandemic. Managing G&A bills doesn’t should be a chore — especially if you have the best instruments in your side. And if you’re able to simplify all of it, Aspire is here to assist your journey with smart, scalable instruments that develop with your business. A strong G&A forecast provides you clarity, especially when you’re applying for business loans, speaking to buyers, or reviewing profitability.

Deposits in Slash enterprise checking accounts are FDIC-insured through Column N.A., Member FDIC and Column’s Sweep Program Community Banks. For administrative roles like HR, IT, or bookkeeping, outside companions can deliver higher quality at a decrease mounted cost than hiring in-house staff. Regularly (monthly or quarterly) evaluation subscriptions, software program companies, and recurring bills.

Controlling wage expenses is essential for the monetary well-being of an organization. Companies can utilize totally different methods like combining job positions, providing performance-related bonuses, and finishing up wage surveys to ensure to optimize their payroll expenditures. Proficient management of salaries can lead to noteworthy savings for an organization. Distant or hybrid work fashions could be a simple way to cut back costs for firms that don’t want staff within the office every single day of the week.

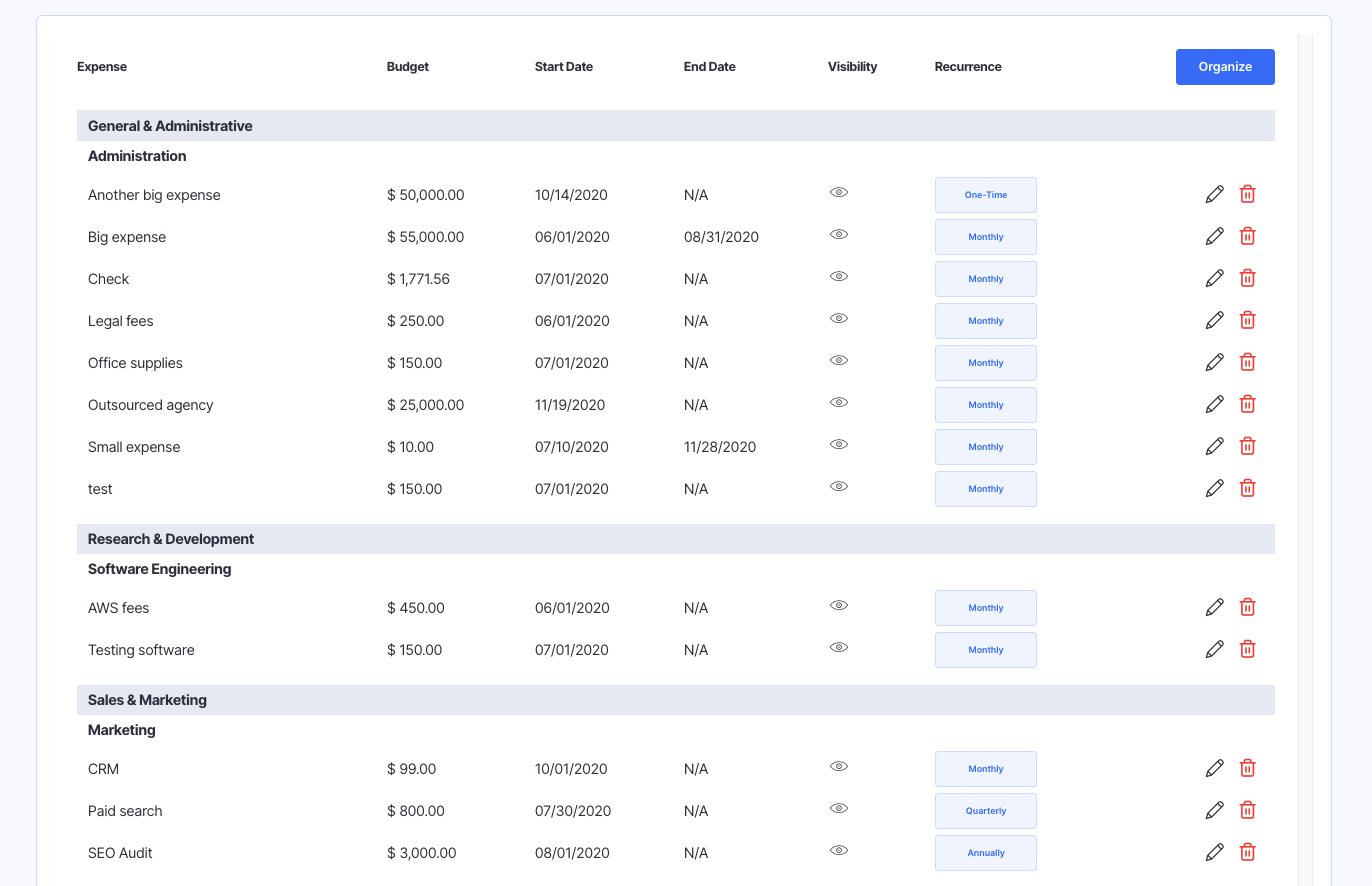

G&A isn’t one-size-fits-all; its nature and administration can differ. Maintaining G&A costs in examine requires vigilance towards widespread pitfalls. Simply recording G&A isn’t enough; analyzing these costs supplies priceless insights. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Get started with Taxfyle right now, and see how filing taxes could be simplified.

Free Course: Understanding Financial Statements

Improper administration of these costs can result in inefficiencies or diminished profitability, whereas a balanced G&A finances allows clever useful resource allocation and maintains important processes. Get your staff to make use of a devoted receipt app to scan and keep track of all receipts. The better you observe every day spending in your business right now, the less doubtless it’ll get uncontrolled sooner or later.

- A small startup will doubtless have lower administrative expenses than an enterprise enterprise, in spite of everything.

- G&A offers with the costs of working and operating your business, things like salaries, utility payments, and supplies.

- You also can remove or alter wasteful features of your small business and focus on more valuable areas of your organization.

Automate extracting, validating, and organizing client tax information. By clicking “See Rippling,” you comply with the usage of your data in accordance with Rippling’s Privateness Discover, including for advertising functions. By clicking “Sign up,” you conform to the use of your information in accordance with Rippling’s Privateness Discover, including for advertising functions. You can also discover ongoing funds that you simply didn’t even find out about.

Many workers will also need a piece telephone to stay related during journeys. Below, we focus on the widespread hurdles businesses face and how Alaan provides sensible options to simplify the process. Enhancing this ratio makes your business extra engaging to buyers and lenders, too. Use software program that permits you to monitor and classify benefits in the right method, so you’re not bundling them with needed https://www.simple-accounting.org/ overheads. Suppose of them as the “assist crew” for your business — not on stage, but absolutely needed for the present to go on.

The Way To Calculate Sg&a Expense?

These prices assist the whole group, not only one project or division. That’ll let you know operating prices as a proportion of your income. And then you’ll find a way to monitor modifications on this percentage, quite than looking at prices on their very own. Some businesses will add biscuits or fruit to stave off mid-morning or afternoon hunger pangs.

This sort of expense is often shown on the revenue statement beneath price of goods offered (COGS) and lumped with selling expenses. It types a selling, basic and administrative expense line item. SG&A bills appear on the revenue statement beneath gross profit and above working profit.

They embody rent, some salaries, employee perks, workplace provides, and rather more. If it doesn’t directly bring in income, it’s likely to be a G&A expense. These are sometimes what we think of as “expenses,” and so they’re usually a ache to manage.